The recent news on the possible dialogue between Turkish and Israeli officials regarding a natural gas pipeline project that will carry Israeli gas to Europe via Turkey has revived the prospects for another round of negotiations between the two states. A gas pipeline deal between Ankara and Tel Aviv, a project discussed following the 2016 rapprochement but halted following the diplomatic escalation, would become propitious for all the regional actors in the Eastern Mediterranean and the final buyer of the gas – the European market.

The Israeli media reported on Sunday and Monday that Turkish officials are ready to negotiate the transfer of Israeli gas to Europe via Turkey, referring to a high-ranking Turkish official's message to Israeli counterparts on the willingness of Ankara to resume talks in the aftermath of establishing a stable government in the country.

Infographic by Büşra Öztürk

The reports also suggested that the Israeli officials welcomed the idea of initiating negotiations for the Turkish proposal to build a gas pipeline from Israeli fields to deliver the gas to Europe.

"It is good to see a positive media discourse emerge on potential cooperation between Israel and Turkey. For a long while, we mostly heard about negative developments in ties," Dr. Nimrod Goren, the founder and head of Mitvim – the Israeli Institute for Regional Foreign Policies, told Daily Sabah, commenting on the recent reports. However, Goren remained cautious of an immediate recovery or quick rapprochement between the two countries.

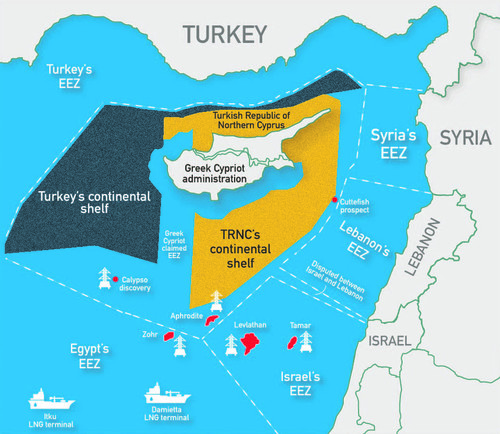

In June 2016, Israeli Energy Minister Yuval Steinitz announced a reconciliation agreement between Ankara and Tel Aviv after six years of strained bilateral relations following the Mavi Marmara incident in 2010. While both parties endeavored to keep the détente and resorted to energy diplomacy as an effective instrument at the time, the changing dynamics of regional politics, Israel's choices of energy partners, moves to exclude Turkey and the Turkish Republic of Northern Cyprus (TRNC) from the share of hydrocarbon resources around the island of Cyprus, and the institution of a framework agreement on the EastMed gas pipeline have greatly hampered the efforts.

"The countries failed to make progress on the issue in 2016-2017, after their reconciliation agreement, when there was more positive momentum in ties," Goren said, emphasizing that it will more difficult for Turkey and Israel to move forward now. However, he argued, a good first step to restore trust and effective working relations between the two countries is to send back ambassadors.

"Throughout the period of crisis in the relations between Turkey and Israel, Ankara has supported conducting discussions with Israel on potential gas supply to Turkey or transit through Turkey. It is true in the current period as well," Brenda Shaffer, a visiting researcher at Georgetown University's Center for Eurasian, Russian and East European Studies (CERES) and senior fellow at Atlantic Council, told Daily Sabah in an exclusive exchange.

One of the main reasons for the escalating tension between Ankara and Tel Aviv in the last two years has been Israeli's energy partnership with Greece and the Greek Cypriot administration to construct a pipeline sponsored by the European Union. In 2017, the energy ministers of Israel, Greece and the Greek Cypriot administration, and the Italian ambassador to Greek Cyprus signed a memorandum of understanding in Nicosia on the pipeline plans in the presence of EU Climate Action Commissioner Miguel Arias Canete.

The long-term project, which has an estimated cost of $7 billion, has been criticized by Turkey as ignoring the sovereign rights of the Turkish Cypriots living on the northern part of the island of Cyprus. Turkish and Turkish Cypriot officials have called for the inclusion of all parties and the fair sharing of resources in the Eastern Mediterranean.

Moreover, in January 2019, the Eastern Mediterranean Gas Forum (EMGF) was founded in Cairo with the participation of the energy ministers of Greece, Italy, the Greek Cypriot administration, Egypt, Jordan, Israel and Palestine. Turkey and Lebanon were the two regional countries that did not attend the forum.

Commenting on the efforts to form a gas cooperation mechanism without Turkey – a major gas market with a highly developed infrastructure network – Shaffer said that it was a huge mistake not to include Ankara up to this point in the Eastern Mediterranean Gas Forum. "It cannot be a forum for cooperation if it does not involve a key player. I hope this will be corrected. Washington should press to include Turkey," she remarked.

In a similar vein, Goren also pointed out the significance of energy cooperation between Turkey and Israel. "Israel should not rule out Turkey's participation in regional gas-related mechanisms and forums on the Mediterranean, and can benefit from more inclusive regional cooperation," he said.

Turkey's role in regional energy

Turkey has been described as the most lucrative route for regional gas – whether it comes from the Caspian Sea, the Russian fields or the Eastern Mediterranean – to reach European markets. The last example of Turkey's successful energy cooperation with regional actors has been epitomized in the Southern Gas Corridor (SGC), which carries Azeri gas from the Shah Deniz-2 field to Europe. The SGC, Petroleum Pipeline Corporation (BOTAŞ), BP and SOCAR Turkey own 51%, 30%, 12% and 7% of the shares in TANAP, respectively.

After the Turkey leg of the SGC, the Trans-Anatolian Natural Gas Pipeline (TANAP) was inaugurated in June 2018 and began pumping gas to the Turkish network at the end of the month, the pipeline was connected to the European section of the Trans Adriatic Pipeline (TAP) at the Turkish-Greek border on Nov. 30. Nearly 95% complete, the TAP – which passes through Greece and Albania and reaches Italy – will release natural gas to the European network in October 2020, according to company officials.

Since the Turkish network has already one connection to the European infrastructure via TANAP and TAP, it would make sense for Israel to capitalize on this existing pipeline network to sell its gas in the European market. In a confirmation of this point, Shaffer stressed that the Southern Gas Corridor consortium would also welcome the supply of Israeli gas to Europe via TANAP.

Apart from SGC, Turkey has also emerged as a significant route for the transfer of Russian gas to Europe with the TurkStream project. Consisting of two lines each with a capacity of 15.75 billion cubic meters of gas (bcm), the second line of the project will run across Europe through Bulgaria, Serbia and Hungary.

Not only do these international natural gas pipeline projects contribute to Turkey's energy supply security, but they also bolster the energy supply of the country's long-standing allies. These pipelines have been accomplished through years of diplomatic efforts, proving the capabilities of all involved parties to create projects that yield beneficial results for regional actors. Seizing the experience of energy diplomacy, Turkey has been insistent on the equal share of Eastern Mediterranean resources and has been open to dialogue with Israeli officials.

"While the establishment of gas supply to or via Turkey from Israel would have many hurdles to overcome, I think the 'energy diplomacy' would serve an important function between the sides," Shaffer said, drawing attention to the importance of keeping bilateral dialogue on energy.

The constantly improving natural gas infrastructure network in Turkey also makes the country a promising candidate for the delivery of the Eastern Mediterranean gas to Europe. With the addition of two new pipelines, Turkey has added three new entry points, reaching seven in total. The entry points include Malkoçlar, Gürbulak, Türkgözü, Durusu, Kıyıköy, Trakya and Eskişehir. I

In addition to pipeline entry points, Turkey also has four liquefied natural gas regasification units – two of them are land-based terminals and two are floating storage and regasification units (FSRU). While a third FSRU will be deployed in the Saros Gulf in Turkish Aegean, the investments to expand the capacity of the storage facilities and the other regasification facilities are still underway. According to a report by the Oxford Institute for Energy Studies, total Turkish entry point send-out capacity including pipeline gas, LNG/FSRU and storage will almost double from the current 258.18 million cubic meters per day to 473.48 million cubic meters per day by 2021.

The route to Europe

Although the gas demand increase in Europe is estimated to remain flat in the next five years according to the International Energy Agency (IEA), the demand for gas itself in Europe will benefit from closures of coal and nuclear plants – albeit remaining limited due to renewable investments. However, the agency said the phasing out of the Dutch Groningen field and depletion in the North Sea will create an additional gap of almost 50 bcm per year, requiring new supply channels.

In this context, Talha Şeker, a political analyst at the Association of Researchers on the Middle East and Africa (ORDAF), stressed that Israel wants to emerge as a new energy actor in the new setting of geopolitics – which highlights the Russian and American conflicts of interest in the European energy market. "The European Commission therefore sponsors and champions a gas pipeline project coming from Israel," he said and stressed that an EU-supported gas pipeline project which excludes Turkey but passing through Turkish continental shelf has been the main source of focus of Turkish-Israeli relations in the last year.

"Over the last decade, the EastMed pipeline has been at the core of tensions and rapprochement between Turkey and Israel," Şeker maintained. As far as Şeker is concerned, Turkey's recent maritime deal with Libya has indeed increased the pressure on the EastMed pipeline and the countries that support it. Turkey's deal with the U.N.-backed government in Tripoli has cut Greece's connection with the Greek Cypriot administration and further complicated the future of the pipeline project – which has to pass through Turkey's continental shelf. With regard to the plans of other actors to sell more gas to European markets, Şeker also drew attention to Russia's growing ambition to supply more to Europe with Nord Stream and TurkStream and stressed that this also complicated Israel's plan to become an energy exporter to Europe. "After all, the future of Turkish-Israeli energy talks depends on a very fragile structure of competition and geopolitical rivalry," he said.

Recent gas discoveries

The last decade has witnessed important gas discoveries in the Eastern Mediterranean and propped up the hopes of the littoral states to enter the game of energy exporters. Although potential gas reserves in the overall region are only one-third of the total reserves in the U.S. and one-tenth of Russian potential gas reserves, the discoveries were enough to stoke superannuated tensions in the region.

In 2009, the Noble-Delek consortium announced the first large-scale hydrocarbon discovery in the Tamar field, located 80 kilometers west of Haifa. Tamar is estimated to hold 280 bcm of gas. Shortly after in 2010, the American-Israeli duo announced the largest gas find in the Eastern Mediterranean in the Leviathan field – projected to harbor 540 bcm of gas. These two gas finds created hype and were hailed by many as a game changer and enabled Israel to move toward its ambition to become an energy exporter. Moreover, in 2015, the Italian energy firm Zohr also announced a huge discovery in Egypt's Zohr – estimated to have 850 bcm of gas.

During explorations in 2011, the Noble-Delek duo also reported gas finds in the putative exclusive economic zone (EEZ) of the Greek Cypriot administration – a unilaterally declared area. The Aphrodite field, estimated to harbor 128 bcm of gas, has so far seen no progress regarding the commercialization of the resources because of the 40-year long conflict between the TRNC and the Greek Cypriot administration. Turkey and the TRNC contest the unilateral claims of the Greek Cypriot administration and do not recognize the maritime border delimitation agreements signed with Egypt, Lebanon and Israel.

The Turkish side views the waters on which the Greek Cypriots lay claim as disputed because they are overlapping with the continental shelf of the Turkish Republic. Ankara argues that some of the blocks – particularly Block 4, 5, 6, and 7– on which the Greek Cypriot administration has commissioned international energy companies like the Italian ENI and French Total for explorations violate the country's continental shelf as well as the territorial waters of the Turkish Cyprus.

In defense of its sovereign rights and the interests of the Turkish Cypriots, Turkey has sent seismic and drilling vessels to the region along with its military frigates for protection against any escalation. Currently, Turkey's drilling vessels, Fatih and Yavuz, and seismic vessel Barbaros Hayreddin are carrying out offshore exploration off the coast of Cyprus.

*Elif Binici Erşen